40+ Extra yearly payment mortgage calculator

Ad Our Calculators And Resources Can Help You Make The Right Decision. Amortization extra payment example.

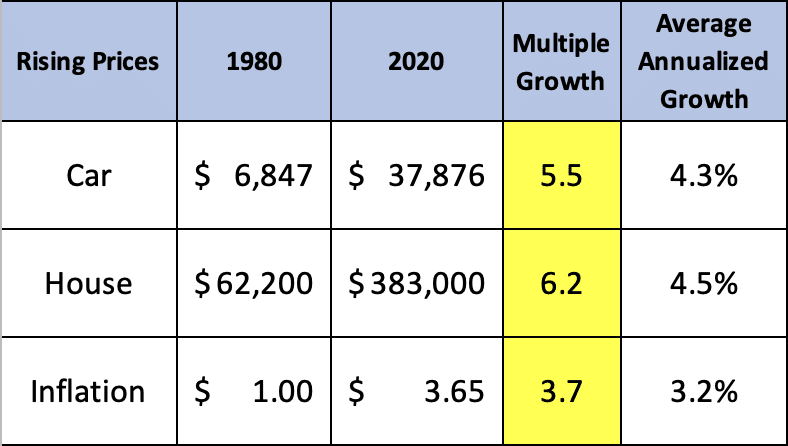

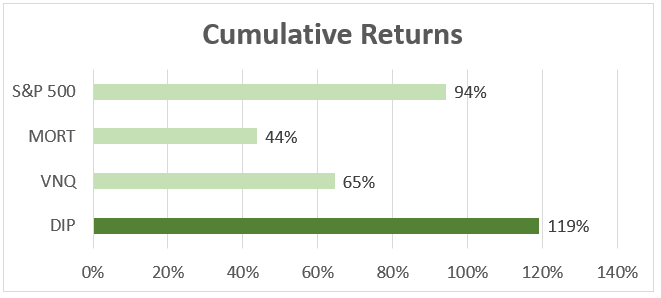

How Dental School Costs Have Changed Over 40 Years Student Loan Planner

511 rows The 40 year mortgage calculator with taxes is a mortgage amortization calculator that will calculate your monthly or biweekly payments with amortization schedule quickly and.

. The calculator lets you determine monthly mortgage payments find out how your monthly. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. Account for interest rates and break down payments in an easy to use amortization schedule.

Estimate The Home Price You Can Afford Using Income And Other Information. There are options to include extra payments or annual. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Receive Your Rates Fees And Monthly Payments. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan. By making additional monthly payments you will be able to repay your loan much more quickly.

Make payments weekly biweekly. This results in savings of 10888604 in interest. By paying extra 50000 per month the loan will be paid off in 15 years and 8 months.

It is 9 years and 4 months earlier. The loan amortization calculator with extra payments gives borrowers 5 options to calculate how much they can save with extra payments the biweekly payment option one time lump sum. If Pay Extra 50000.

How Much Interest Can You Save By Increasing Your Mortgage Payment. Use the Extra Payments Calculator 2 to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan. Compare Quotes See What You Could Save.

Additional Payment Calculator Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Ad Get Offers From Top Lenders Now. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Use this calculator to calculate repayment of your mortgage and add extra payments to find how much it reduces the length of your loan term and the amount of interest you can save over the. Paying an extra 100 a month on a 225000 fixed-rate loan with a 30-year term at an interest rate of 3875 and a down payment of 20 could save you. Extra Payment Mortgage Calculator to Calculate Mortgage Payoff Savings This free online mortgage amortization calculator with extra payments will calculate the time and interest you.

Find Mortgage Lenders Suitable for Your Budget. Use our free mortgage calculator to estimate your monthly mortgage payments. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

How Much Should I Have Saved In My 401k By Age

How Dental School Costs Have Changed Over 40 Years Student Loan Planner

How Much Should You Save By Age 30 40 50 Or 60 Financial Samurai

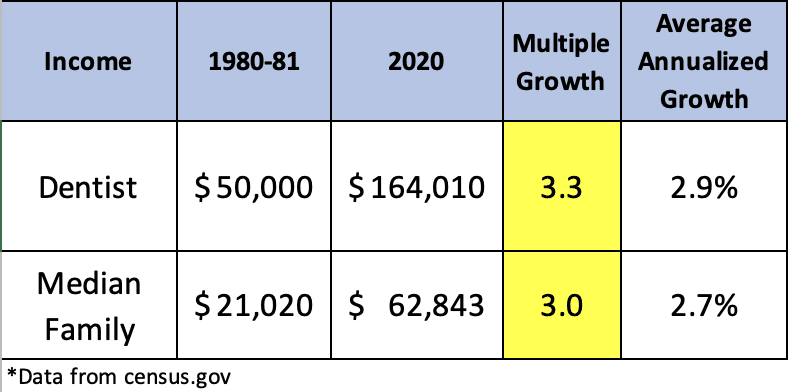

Deadweight Loss Formula How To Calculate Deadweight Loss

Retirement Strategy The 500 000 Hypothetical Portfolio Seeking Alpha

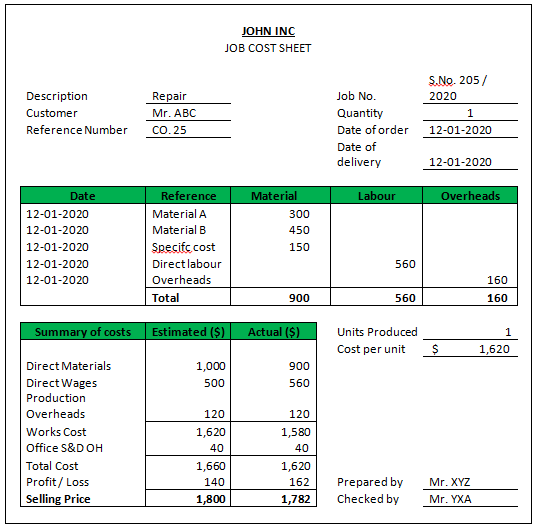

Job Costing Complete Guide On Job Costing In Detail

Use This Tri Fold Brochure To Market Your Business And Provide Customers A Menu Of Your Goods And Services With A Price Li Brochure Price List Trifold Brochure

I Make 15 An Hour I Work A 40 Hour Week How Much Do I Take Out For Taxes Since I M Self Employed Quora

2

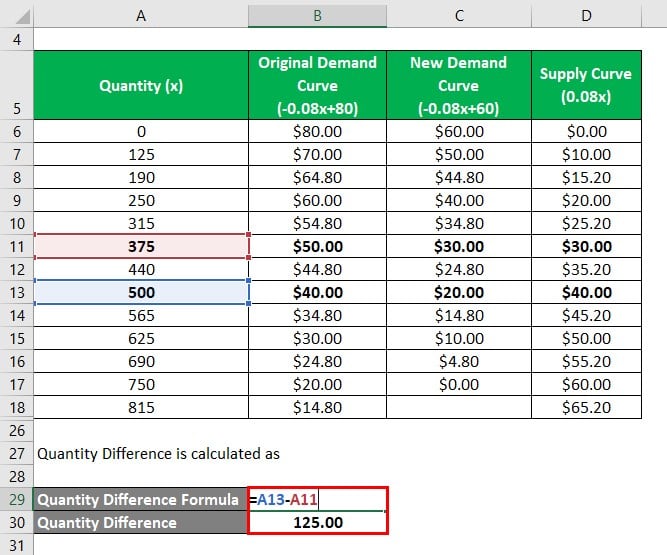

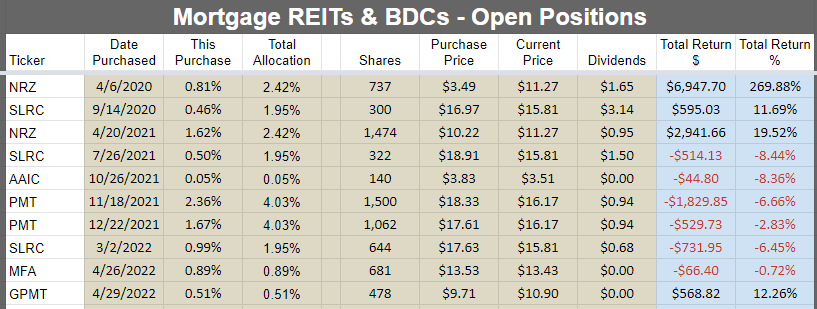

13 Dividend Yield And A Big Discount To Nav Wrecks 12 Seeking Alpha

Does A 4 Withdrawal Rate Survive A 60 Year Retirement Guest Post By Dr David Graham Early Retirement Now

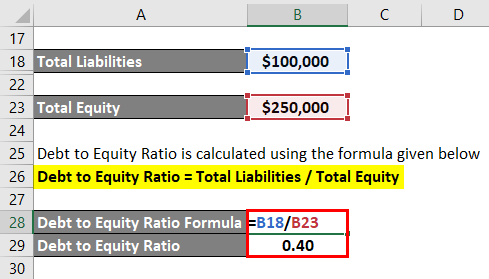

Debt To Equity Ratio Formula Calculator Examples With Excel Template

How Much Savings Should I Have By 40 A Retirement Savings Guide

How Much Should You Save By Age 30 40 50 Or 60 Financial Samurai

How Investors Can Benefit From Real Estate

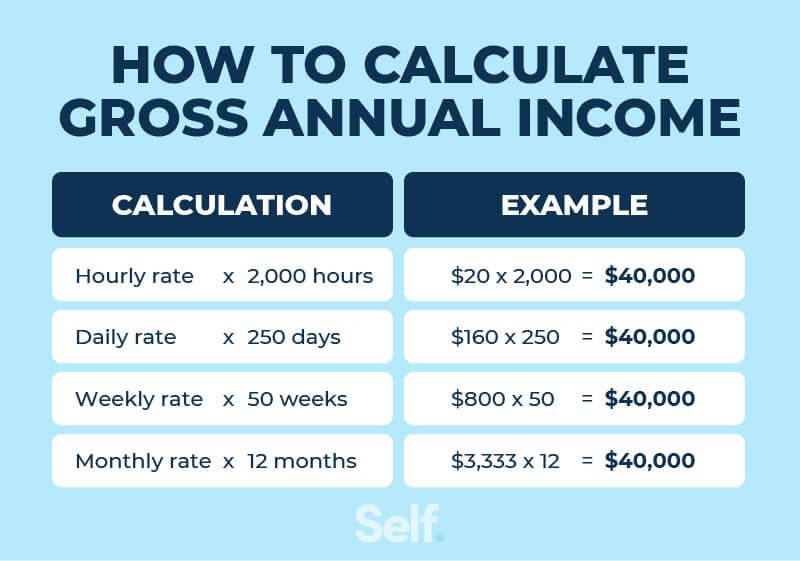

What Is Annual Income And How To Calculate It Self Credit Builder

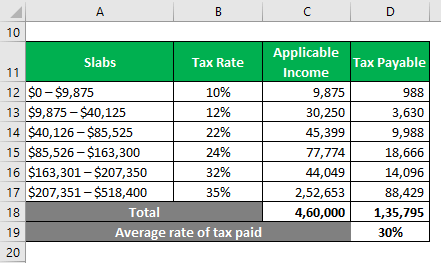

Progressive Tax A Complete Guide On Progressive Tax In Detail